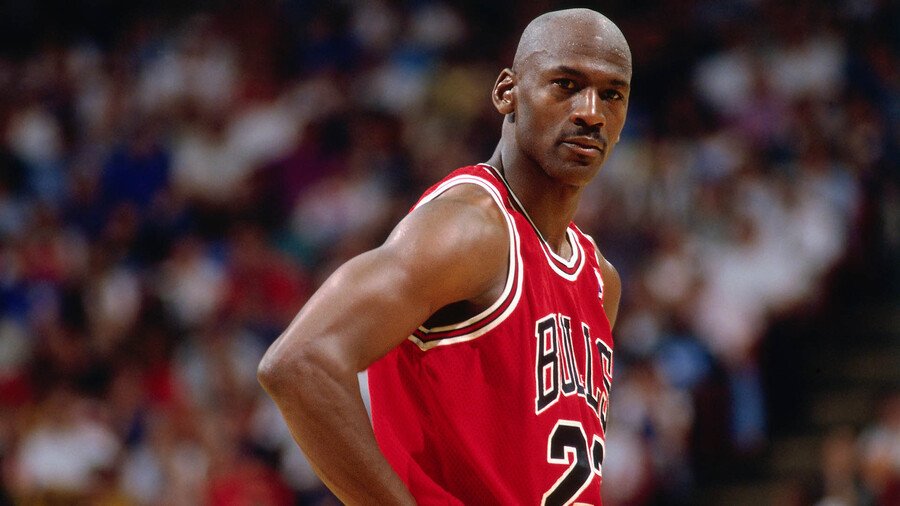

Michael Jordan Being the Spark of the Jock Tax

Michael Jordan is a name that needs no introduction in the world of basketball. The iconic player, who is widely considered as one of the greatest basketball players of all time, has had a profound impact on the sport, both on and off the court. But did you know that Michael Jordan is also responsible for the introduction of a tax law that has affected professional athletes for decades? This tax law is known as the "jock tax," and it was Michael Jordan's move to California in the 1990s that sparked its creation.

Before we dive into the story of how Michael Jordan became the reason for the jock tax, it's important to understand what exactly this tax is. The jock tax is a state income tax that is imposed on professional athletes who play in states outside of their home state. This tax applies to all professional athletes, including those who play in sports other than basketball. The idea behind the jock tax is that it allows states to collect additional revenue from the large salaries that professional athletes earn.

Now, let's go back to the 1990s when Michael Jordan was at the peak of his basketball career. At the time, Jordan was playing for the Chicago Bulls, and he was earning a massive salary. In 1991, Jordan and the Bulls won their first NBA championship, and Jordan's fame and popularity skyrocketed. As a result, Jordan became one of the most sought-after athletes for endorsement deals and appearances.

One of the states that was particularly interested in having Jordan make an appearance was California. California was home to many of the world's top celebrities, and Jordan was no exception. He was invited to appear on numerous TV shows, attend award ceremonies, and make other public appearances. In 1993, Jordan finally decided to purchase a home in California, making it his second home after his primary residence in Illinois.

Jordan's move to California caused a bit of a stir, not just in the world of basketball but also in the world of tax law. You see, California is one of several states that have a jock tax, and by purchasing a home in California, Jordan became subject to this tax. This was a big deal, as Jordan's massive salary meant that he would be paying a significant amount of money in state income tax to California.

The jock tax had existed before Jordan's move to California, but it was largely ignored by many athletes and their agents. However, Jordan's move to California brought the issue to the forefront, and many other states soon followed suit by imposing their own jock tax laws.

In the years since Jordan's move to California, the jock tax has become a staple of tax law for professional athletes. Today, nearly every state that has an income tax also has a jock tax, and it is considered a significant source of revenue for these states.

In conclusion, Michael Jordan's move to California in the 1990s was a significant event in the world of tax law. It was his move that sparked the creation of the jock tax, which has since become a significant source of revenue for states across the country. While the jock tax may be a headache for professional athletes, it has helped states collect additional revenue and has played an important role in shaping tax policy in the United States.